22 rue jean wolter L-3544 DUDELANGE LUXEMBOURG

- 22 rue Jean Wolter, L-3544 Dudelange, Luxembourg

- +352 27 40 90 40

- contact@exocent.lu

The Model

EXOCENT > The Model

EXOCENT fund

Asset management at Exocent Fund: A structured, rigorous process

Our customers include :

-Our investors come from a wide range of backgrounds:

It encompasses individuals with diverse backgrounds, such as innovative entrepreneurs, experienced executives, registered account holders, recognized professionals in the arts and sports, and second-generation wealth-holders. Exocent Fund is also open to institutional investors such as family offices, investment funds, banks and private companies, and our investors include holders of direct crypto-assets.

The Exocent Model offers :

- When you invest with Exocent, you choose recognized, proven expertise, enabling you to control the risks to your assets while optimizing performance potential.

Our approach integrates meticulous risk management with prudent stewardship, even in the face of intense volatility, ensuring perfect alignment with your investment objectives.

Our detailed reports give you precise, transparent monitoring of your assets.

Our commitment to strong, sustainable performance is underpinned by a team of experienced professionals, rigorously applied risk management, and controlled exposure to a broad spectrum of investments and geographical exposures: equities, currencies, digital assets (crypto-assets) and funds with recognized track records. Our partners' trust is the best indicator of our commitment.

The INVESTMENT cycle

Exocent Fund's risk management of your portfolio is based on a methodical five-step framework, ensuring a strategic and tailored approach.

Step 1: Identification and assessment of specific risks

- Definition: This initial step consists in exhaustively identifying all the types of risk to which the portfolio is exposed, given its speculative strategy. This includes not only traditional market risks (equity volatility, interest rate fluctuations, currency fluctuations), but also risks specific to speculative investments (illiquidity, concentration, counterparty, leverage risk, regulatory risk, operational risk).

- Key actions :

- In-depth analysis of portfolio positions and financial instruments used (funds, equities, currencies, cryptocurrencies, etc.).

- Stress test scenarios to assess the impact of extreme events on the portfolio.

- Fundamental and technical analysis to identify risks specific to the assets held.

- Assessment of asset liquidity and financing risks.

- Monitoring regulatory developments and compliance risks.

- Identification of potential operational risks (systems, personnel, processes).

- Use of quantitative and qualitative models to assess the probability of occurrence and potential impact of each identified risk.

Step 2: Definition of Tolerance Limits and Risk Limits

- Definition: Once the risks have been identified and assessed, this crucial step involves establishing clear tolerance thresholds and specific risk limits for the portfolio and its various components. These thresholds reflect the risk appetite of the fund and its investors.

- Key actions :

- Definition of exposure limits by asset type, geographic sector, issuer and strategy.

- Setting limits on the use of leverage.

- Setting maximum acceptable loss thresholds for the overall portfolio and for specific periods.

- Setting concentration limits to avoid over-reliance on a single asset or strategy.

- Definition of alert thresholds to trigger corrective action when risk levels approach established limits.

- Clear communication of risk tolerances and limits to all stakeholders.

Stage 3: Implementing risk mitigation strategies

- Definition: This stage involves putting in place concrete tools and strategies to reduce the probability and/or impact of identified risks that exceed tolerance thresholds.

- Key actions :

- Portfolio diversification across asset classes, sectors and geographies.

- Use of hedging instruments to mitigate market and currency risks.

- Adjustment of asset allocation according to changing market conditions and risk levels.

- Reduce leverage if necessary.

- Implementation of liquidity management procedures to meet financing needs and potential redemptions.

- Rigorous selection of counterparties and ongoing monitoring of their solvency.

- Strengthening internal controls and operational processes.

Step 4: Continuous monitoring and risk measurement

- Definition: Risk management is a dynamic process that requires constant monitoring and regular measurement of portfolio risk levels. This ensures that risks remain within acceptable limits and that mitigation strategies are effective.

- Key actions :

- Daily monitoring of portfolio positions and key risk indicators (VaR, stress tests, liquidity ratios, etc.).

- Regular reporting on risk exposure and performance against established limits.

- Analysis of deviations from tolerance levels and identification of emerging risk factors.

- Periodic stress tests and sensitivity analyses to assess the portfolio's resilience to adverse scenarios.

- Regular review of risk models and their assumptions.

Step 5: Review, Adaptation and Continuous Improvement of the Risk Management Framework

- Definition: The final stage involves periodically assessing the effectiveness of the risk management framework, adapting it to changes in the market, fund strategy and regulations, and identifying areas for improvement.

- Key actions :

- Internal and/or external audits of risk management processes.

- Regular review of risk management policies and procedures.

- Analysis of incidents and losses to identify weaknesses in the framework and implement corrective measures.

- Integration of best practices in risk management.

- Ongoing training for GFIA members on aspects related to the management of

risks. - Adaptation of the risk management framework in response to changes in the fund's investment strategy, market conditions and regulatory environment.

A partnership based on excellence and trust

Risk warning ⚠️ Warning! ⚠️

Consulting the website alone is not enough to make an investment decision. It is advisable to analyze Exocent Fund's corporate contract, subscription agreement and key information document, where applicable. Any investment in Exocent Fund may result in a financial loss, and Exocent Fund does not guarantee the capital invested.

EXOCENT FUND

Our Principles

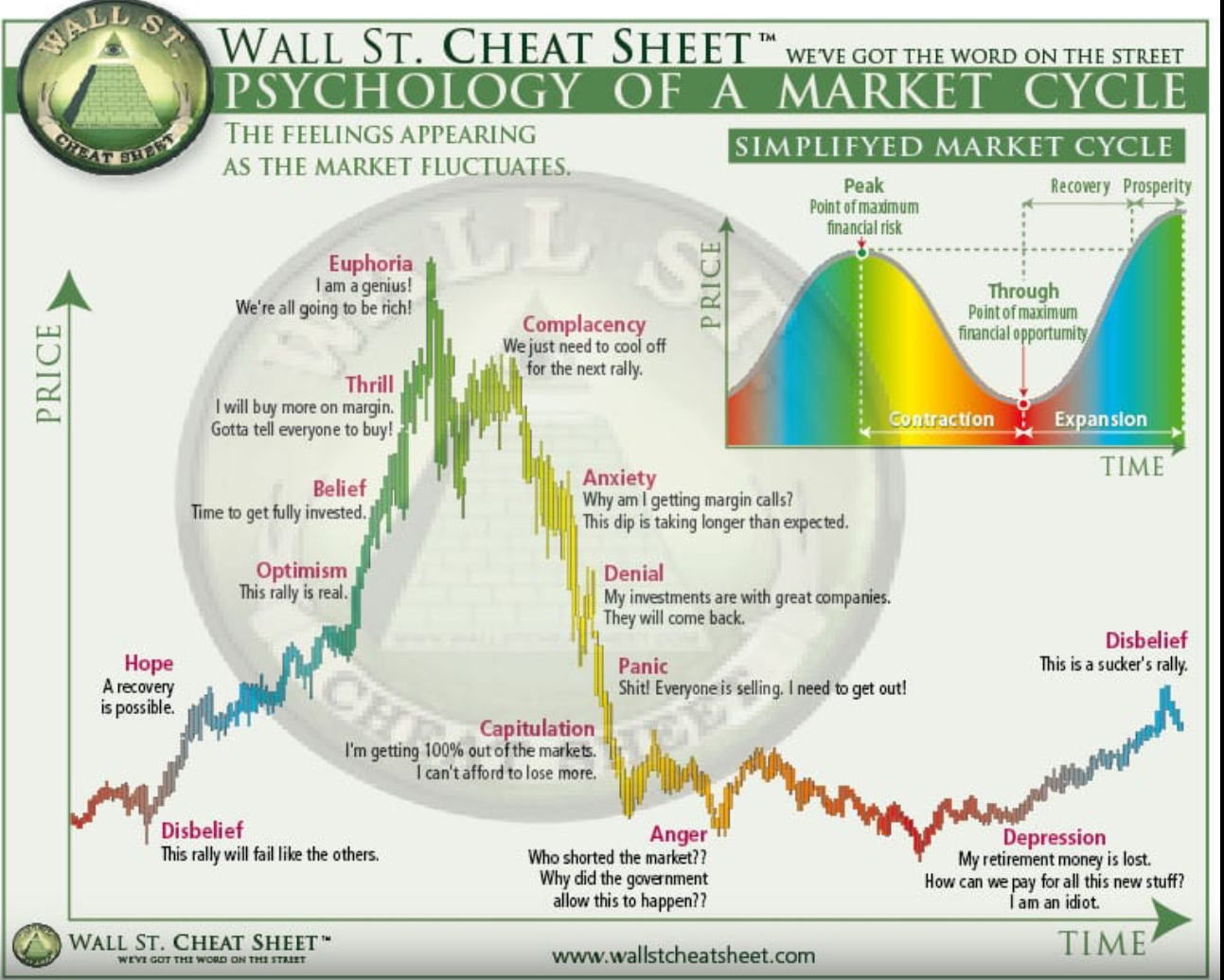

An anxiety-provoking universe!!!

The price of a crypto-currency, currency or other asset does not always reflect its true value.

It is often influenced by investors' cognitive biases, which can create opportunities for those who know how to identify and exploit them.

Investors are often victims of psychological biases that lead them to make irrational decisions.

These biases include :

- Loss aversion: Investors tend to fear losses more than they value equivalent gains.

- Overconfidence: Investors are often overconfident in their abilities and tend to underestimate risk.

- Confirmation bias: Investors look for information that confirms their existing opinions and ignore contrary information.

By understanding these biases, we can make more rational investment decisions.

For example, an investor might buy a crypto-currency, currency or other asset whose price is undervalued due to temporary negative sentiment, or sell an asset whose price is overvalued due to excessive hype.

It's important to note that exploiting investors' cognitive biases is not a risk-free strategy.

It's important to do your own research and make sure the investment is fundamentally sound before making a decision.

Here are a few examples of investments that can benefit from investors' cognitive biases:

- Investing in value assets: Value assets are assets priced below their intrinsic value. They are often abandoned by investors out of fear or pessimism.

- Investing in counter-cyclical assets:

- Counter-cyclical assets are assets whose price moves in the opposite direction to the market. They can be bought when the market is falling and sold when the market is rising.

In conclusion, investors' cognitive biases can create opportunities for those who know how to identify and exploit them.

It's important to do your own research and make sure the investment is fundamentally sound before making a decision.

Our management process

The aim of EXOCENT Fund :

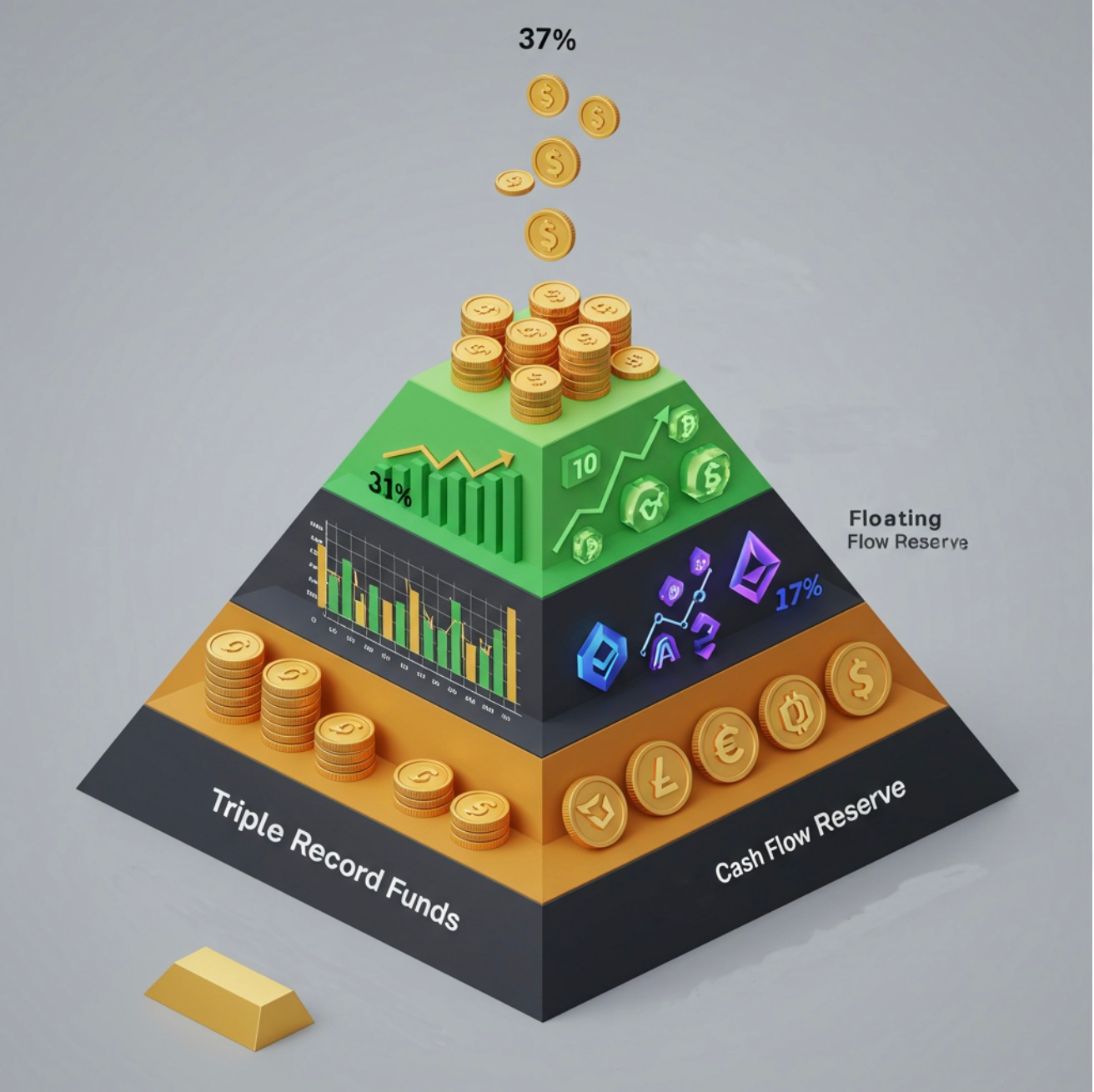

Aims to increase capital over the short, medium and long term, while offering downside protection through diversification of investment types and investments.

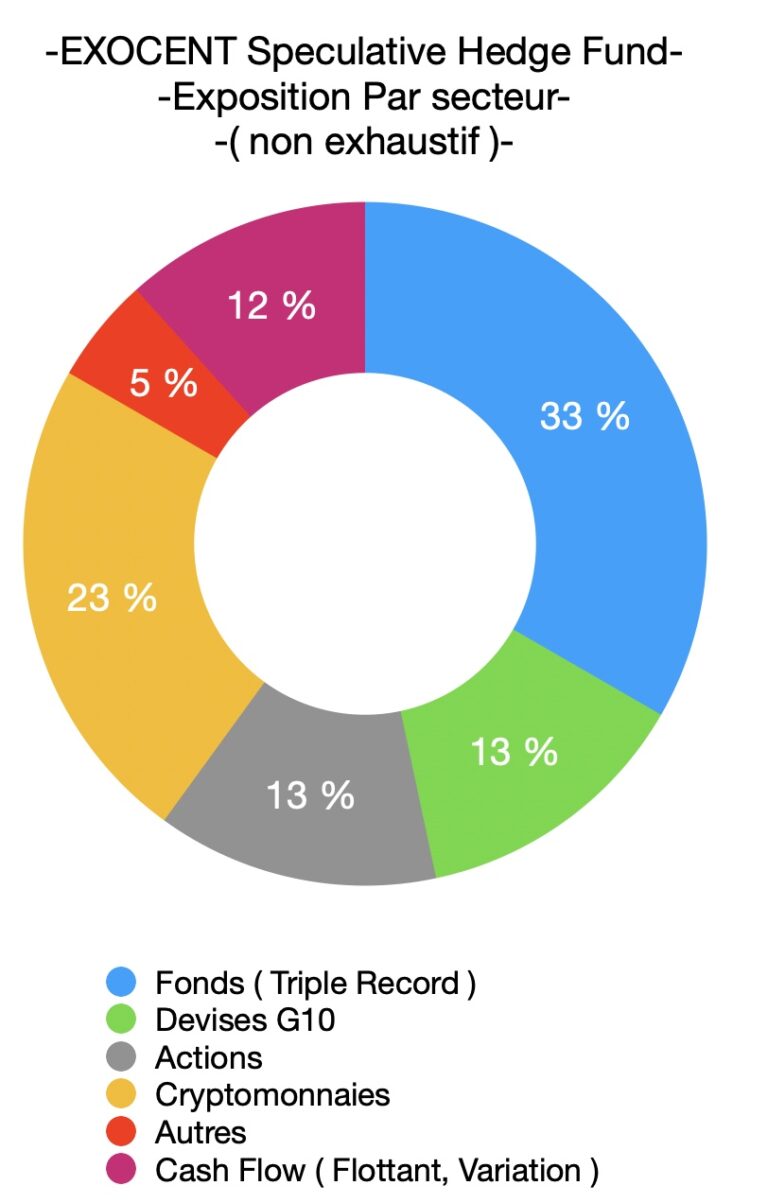

To achieve this objective, the fund invests in large- and mid-cap cryptocurrencies such as BTC and ETH, regulated investment funds not invested in crypto, and listed equities of listed companies.

It manages risk through the sale of Short contracts ( Sales ) .

EXOCENT FUND :

A multidimensional approach to maximize your returns.

Our investment philosophy is based on a rigorous, multi-dimensional analysis of financial markets.

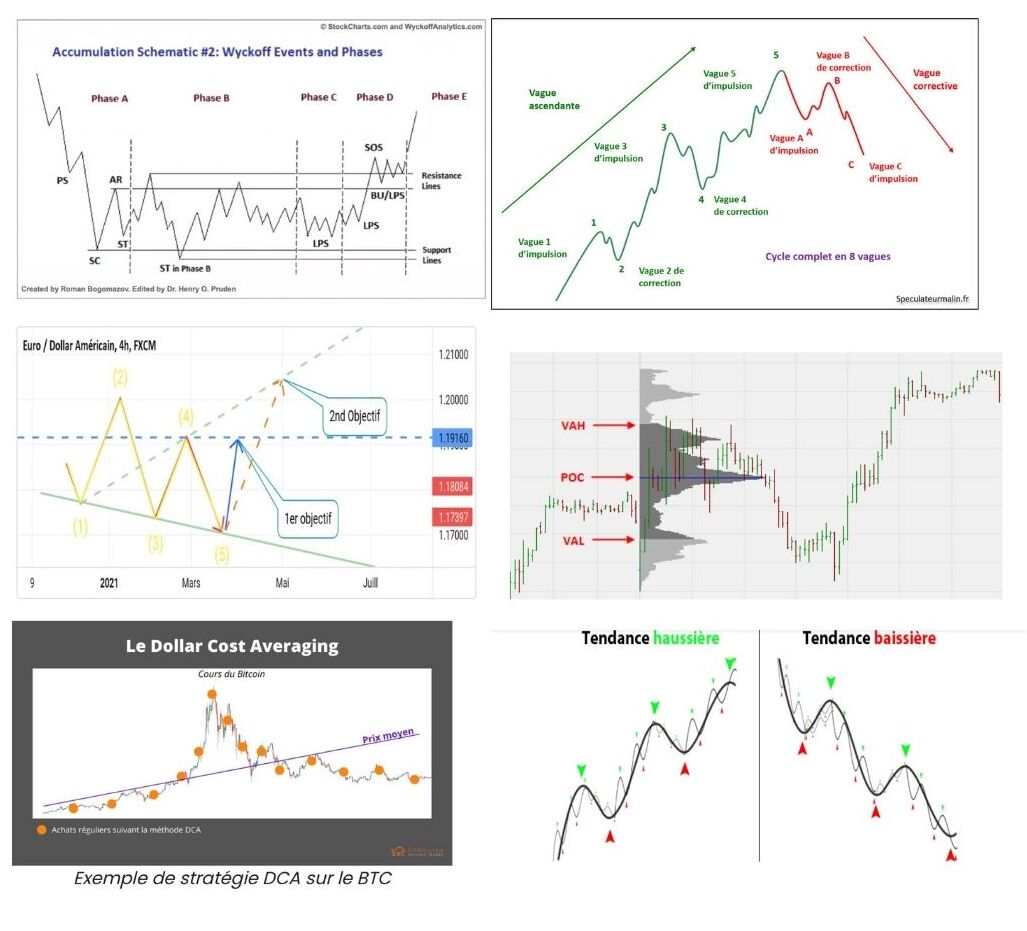

We combine the expertise of several technical analysis theories, including :

- Wyckoff's theory: to identify market consolidation and accumulation phases.

- Elliott wave theory: to anticipate trend cycles and turning points.

- Dow's theory: to identify key market trends and their implications.

- Trend wave analysis ( Wolfe ): to determine short- and medium-term price movements.

- Volume analysis: to identify the participation of institutional investors and "smart money".

By combining these different approaches, we are able to build up a comprehensive view of the market and make informed investment decisions.

Primarily adopting a Dollar-Cost Averaging (DCA) strategy, the fund selects tokens linked to high-quality blockchain models, with attractive valuations and short- to medium-term catalysts, such as plans exceeding future expectations.

Depending on the portfolio's overall valuation, its potential for appreciation and the perceived risk, the fund adjusts its exposure and liquidity level.

In the near future, EXOCENT Fund will set up a DAO enabling all its investors to contribute to and participate in defining part of EXOCENT Fund's strategy through voting.

The way we think about management...

Our investment strategy is positioned at the forefront by incorporating a dynamic allocation to cryptocurrencies, while relying on performance pillars represented by large caps (Euro Stoxx 600, S&P 500, Nikkei 225 - capitalization of at least 10 billion euros) and a selection of high-quality funds with significant size. None of these indices is used as a reference or benchmark.